Popular keywords : 2520 stainless steel pipe, 304 stainless steel seamless pipe, 310S stainless steel pipe

More than 20 years of industry experience

Finished product inventory: It has two storage centers, Songyang and Wenzhou

Spot materials: various materials and specifications are complete

Cargo shipments - more than 20 countries worldwide

MOREOur specialty products

310S (2520) and large diameter seamless pipe

310S high temperature resistant steel pipe

Oxidation resistant steel pipe

Large diameter stainless steel seamless pipe

MORE

Quality assurance

Quality system - ISO system

Finished product testing - complete testing equipment

Management system - internal software

MOREWorkshop equipment

More than20years experience in stainless steel pipe production

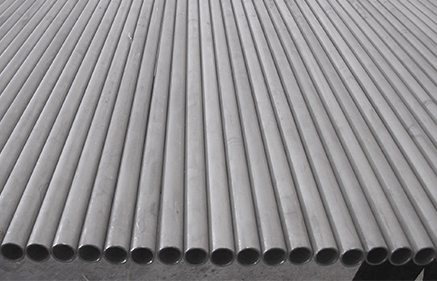

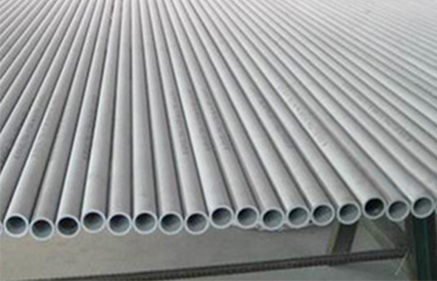

Stainless steel seamless pipe

Specifications : 14mm-630mm

Thickness : 4.00mm-100.0mm

Standard : 06Cr19N;TP304;TP321;TP316;310S;S2205;S2507;904L,etc

Large diameter seamless pipe

Specifications : 14mm-630mm

Thickness : GB 13296-20123;ASTM-A213,etc

Standard : 06Cr19Ni10;TP304;TP321;TP316L;310S/2520;S2205;S2507;904L,etc

Stainless steel boiler tube

Specifications : 6mm-630mm

Thickness : s2205; S2507; 904L; 310S, etc

Standard : GB/T 21833-2008; ASTM A204;etc

Special stainless steel pipe

Specifications : 6mm-630mm

Thickness : GB/T14976-2012; ASTM-A312;etc

Standard : 06Cr19Ni10;TP304;TP321;TP316L;

Provide efficient solutions for various industries

Insg: the oversupply scale of the global nickel ma···

2021/11/20

Baosteel successfully trial produced super ferriti···

2021/11/20

2016 maintenance plan of Guangxi Jinyuan nickel in···

2021/11/20

China's stainless steel production decreased in th···

2021/11/20

International financial markets - overnight inform···

2021/11/20

Government leaders visited our company for inspect···

2021/11/20